U.S. House passes SAFE Banking Act

By Dan Karpiel

The Surveyor

Colorado representatives were at the forefront this week on Capitol Hill in Washington as the United States House of Representatives passed the Secure and Fair Enforcement (SAFE) Banking Act of 2019.

The bill was originally introduced by Congressman Ed Perlmutter, who represents Colorado’s seventh congressional district that encompasses the northern and western Denver suburbs, and it passed by an overwhelming margin, 321-103, last Wednesday.

According to a press release, the bill contains four central points. One, prohibiting, penalizing, or discouraging a bank from providing financial services to a legitimate state-sanctioned and regulated cannabis business, or an associated business (such as an lawyer or landlord providing services to a legal cannabis business). Two, terminating or limiting a bank’s federal deposit insurance solely because the bank is providing services to a state-sanctioned cannabis business or associated business. Three, recommending or incenting a bank to halt or downgrade providing any kind of banking services to these businesses and, four, or taking any action on a loan to an owner or operator of a cannabis-related business. The bill also would require banks to comply with current Financial Crimes Enforcement Network (FinCEN) guidance, while at the same time allowing FinCEN guidance to be streamlined over time as states and the federal government adapt to legalized medicinal and recreational cannabis policies.

Colorado Senator Michael Bennett, who is the cosponsor of a sister bill in the U.S. Senate, said in a press release, “The lack of access to banking services for marijuana businesses is a public safety issue in Colorado and across the country. This common-sense bill would allow our banking system to serve marijuana businesses the same way they serve any other legal places of business. I’m grateful to Congressman Perlmutter for his leadership in pushing this bill across the finish line. We will continue our efforts to move this bill in the Senate.”

Because cannabis is still illegal under federal law, many cannabis businesses which operate in states that have legalized the product, either for medicinal or recreational purposes, or both, banks and other financial institutions can still be prosecuted under federal law. In 2018 Colorado sales of marijuana and other cannabis-derived products topped $1.55 billion, according to a report by CNBC.

Yet, with these businesses denied access to the banking system, many are forced to operate using large sums of cash which, proponents of the SAFE Banking Act argue, creates a public safety risk. Furthermore, it makes it more difficult for states and municipalities to collect taxes on the sales. Since marijuana became legal in Colorado, the state has collected more $927 million in tax revenue.

Reached for comment, Congressman Joe Neguse, whose second congressional district includes Berthoud, said, “It’s an incredible step forward for the state. We’ve been advocating for safe banking solutions for the cannabis industry for quite some time and it really is a public safety issue. The notion that you have millions of dollars, hundreds of millions of dollars potentially, in the streets because of the unavailability of banking options is an untenable situation.”

Neguse expressed optimism that the Senate will act on the bill soon, stressing that the matter is one about business and public safety and not about marijuana and cited the bipartisan support the bill has received from Bennett as well as Republican Cory Gardner.

At this time, it is unknown when the U.S. Senate will take action on the legislation.

- May, 05 2017

Things warm up at the fire station

By Bob McDonnell The Surveyor Photo by Mike BrunerLeft to right:...

- March, 25 2022

Three Berthoud Robotics teams head to...

Three Berthoud Robotics teams are headed to the VEX Robotics Worlds Championship this year to...

- August, 02 2019

Making lemonade out of lemons

The Surveyor - Our Voice It has been one of the more divisive issues to...

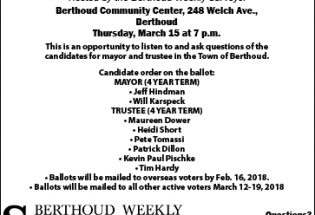

- March, 12 2018

- May, 02 2019

Unwelcomed advances from “kissi...

By Amber McIver-Traywick The Surveyor Although they aren’t new to Colorado, Triatoma protracta, one of...

- May, 18 2023

An old veterans trip to remember

Photo by Bob McDonnellThe U. S. Air Force Memorial was the...

Unified basketball comes to Turner Middle School

Community News

Mike Grace says goodbye as Brett Wing joins town board

Community News

POLICEBLOTTER

Community News

Northern Water sets C-BT quota at 70% for 2024

Community News

Emotions run high during Revere Property hearing

Community News

Snowpack at 119% above normal

Community News

Karspeck to serve third term as Berthoud mayor

Community News

COMMUNITY CALENDAR:

Community Calendar – add an event

Homestead Fine Art Gallery First Fridays OPEN HOUSE

03 May 4:00 PM - 7:00 PM

Homestead Fine Art Gallery First Fridays OPEN HOUSE

07 Jun 4:00 PM - 7:00 PM

Homestead Fine Art Gallery First Fridays OPEN HOUSE

05 Jul 4:00 PM - 7:00 PM

Homestead Fine Art Gallery First Fridays OPEN HOUSE

02 Aug 4:00 PM - 7:00 PM

Homestead Fine Art Gallery First Fridays OPEN HOUSE

06 Sep 4:00 PM - 7:00 PM

Homestead Fine Art Gallery First Fridays OPEN HOUSE

04 Oct 4:00 PM - 7:00 PM